We’re here to make insurance feel simple, clear, and stress-free. At OnePoint Insurance Agency, we’ll help you find the right coverage so you can focus on living, while we protect the things that matter most.

COMPANY

CLIENT TOOL

CONTACT INFORMATION

555 NorthPoint Center E, Alpharetta, GA 30022

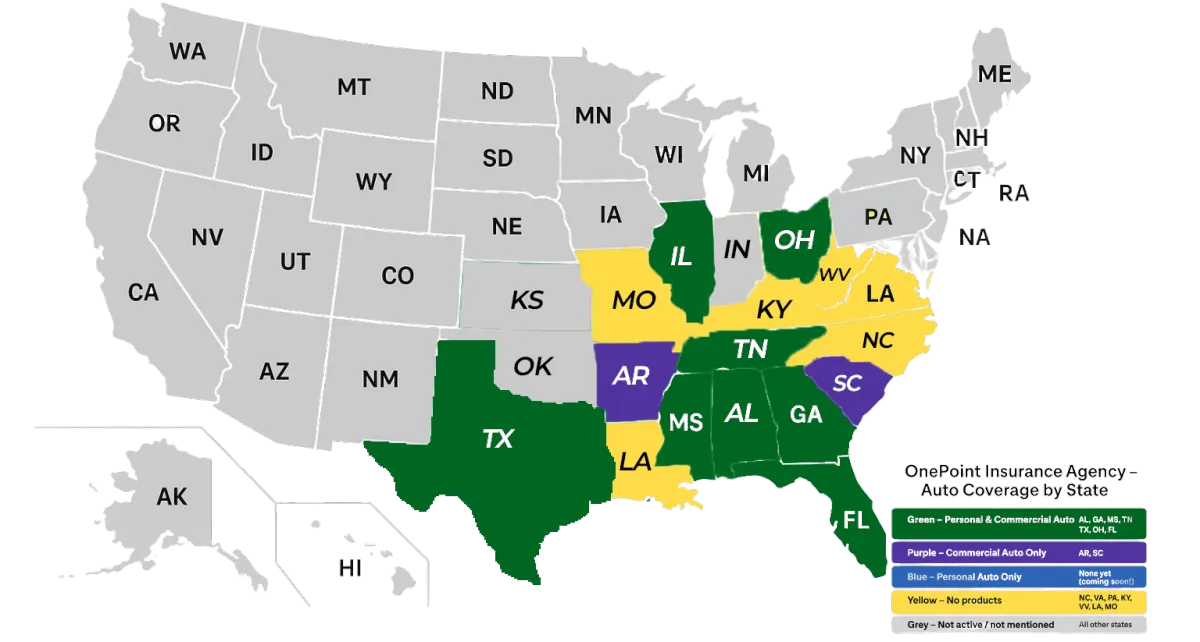

Servicing Families and Business in:

Copyright 2025. OnePoint Insurance Agency. All Rights Reserved.

Homeowners Insurance Coverages

Dwelling Coverage

Dwelling coverage, also known as Coverage A, forms the backbone of your homeowners insurance policy. It provides protection for the physical structure of your home against a wide array of risks. These risks, or "perils," typically include fire, wind, hail, lightning, vandalism, theft, and sometimes even volcanic eruptions. This coverage is what ensures that if your home is damaged or destroyed by one of these events, you have the financial resources to rebuild or repair it.

This portion of your policy generally applies to the main house itself and anything that is physically attached to it. This could include garages, decks, patios, built-in appliances, and other integral parts of your home's structure. Coverage A is calculated based on the estimated cost to rebuild your home from the ground up, using similar materials and quality of construction. This is known as the "replacement cost."

Key Factors in Determining Dwelling Coverage

Square Footage: The size of your home has a significant impact on rebuild costs.

Building Materials: Premium materials (brick, hardwood, tile roofing) require more coverage.

Labor Costs: Regional differences in construction labor can change the amount needed.

Local Building Codes: Older homes might need upgrades to comply with current codes during reconstruction.

Exclusions:

Floods and earthquakes are not covered under standard Coverage A and require separate policies.

Poor maintenance, wear and tear, and intentional damage are typically excluded.

Example Scenario: Your two-story colonial suffers significant damage after a fire caused by faulty wiring. Coverage A would pay for demolition, debris removal, and full rebuilding, including all fixed structures like the kitchen, bathrooms, staircase, HVAC system, and roof.

Other Structures Coverage

Other Structures provides insurance for buildings and structures on your property that are not directly attached to your main residence. These could include detached garages, sheds, guest houses, fences, driveways, gazebos, greenhouses, pool houses, and even wells or septic tanks.

While these may seem secondary, many homeowners have invested considerable value into these structures. A fire, storm, or vandalism could leave you with costly repairs or replacements that aren’t covered unless you have adequate Coverage

Key Factors in Determining Other Structures Coverage

Default Limit: Typically 10% of your dwelling limit, but this can be increased.

Shared Uses: If your detached structure includes both personal and business use (like a home workshop), business portions may be excluded.

Included Perils: Mirrors the perils covered under Coverage A unless specifically excluded.

Example Scenario: A windstorm knocks a tree onto your detached garage, destroying the roof and crushing your stored lawn equipment. Coverage B covers the cost to rebuild the garage and replace damaged contents that fall under Coverage C.

Personal Property Coverage

Personal Property protects the contents of your home and any belongings that belong to you, whether they are inside your home or temporarily offsite. This includes furniture, appliances, electronics, clothing, artwork, and other personal effects.

Special Limits:

Jewelry: $1,500

Firearms: $2,500

Cash: $200

Electronics: May vary

To ensure full protection for high-value items, you should consider adding a "scheduled personal property" endorsement, which expands coverage and removes deductibles in many cases.

Replacement Cost vs. Actual Cash Value:

Actual Cash Value (ACV): Pays the depreciated value of an item.

Replacement Cost: Pays to replace the item with a new one of similar quality.

Off-Premises Coverage: Your items are often covered even when you’re away from home. For instance, if your laptop is stolen at a coffee shop, it’s still covered under Coverage C.

Example Scenario: A burst pipe floods your living room and ruins your furniture, area rug, and TV. Coverage C reimburses you for the replacement of these items, either at ACV or replacement cost, depending on your policy.

Loss of Use Coverage

This part of your policy comes into play when your home becomes uninhabitable due to a covered loss. It pays for the increased cost of living elsewhere while your home is repaired or rebuilt.

Covered Costs Include:

Hotel or rental home expenses

Restaurant and food bills

Pet boarding

Storage costs

Transportation increases

Reimbursement Models:

Actual expenses: You’re reimbursed for the additional living expenses beyond your normal costs.

Fair rental value: If you rent out part of your home and it's unlivable, this coverage may reimburse lost income.

Duration: Usually lasts until your home is repaired or rebuilt, up to policy limits (often 20-30% of Coverage A).

Example Scenario: After a fire damages your roof and causes water to enter your home, repairs take 3 months. You stay in a rental, and Coverage D pays your monthly rent, utility connection fees, and dining out costs.

Personal Liability Coverage

Personal Liability Coverage steps in when you’re legally responsible for injuring someone or damaging their property. This can apply both on and off your premises and includes legal defense costs.

Common Claims:

Slip-and-fall accidents

Dog bites

Injuries from falling tree branches

Damage caused by children or pets

Legal Fees: The insurer typically pays legal defense costs, settlements, and court awards up to the policy limit.

Exclusions:

Intentional injuries

Business activities

Car accidents (covered under auto policy)

Umbrella Coverage: If your liability exposure exceeds your home insurance limits, umbrella policies provide added protection.

Example Scenario: A guest trips on your icy driveway and suffers a concussion. They sue for medical expenses and pain & suffering. Your policy covers the legal defense and eventual settlement.

Medical Payments Coverage

This portion is designed for minor injuries that occur to guests on your property. It’s paid regardless of legal fault and is meant to avoid lawsuits

Examples of Covered Costs:

Ambulance rides

ER visits

Minor surgery or follow-up care

Fast Claims: This type of coverage is known for its quick claims process since it avoids legal entanglement.

Limitations:

Only applies to non-residents (guests, delivery people)

Doesn’t cover family members or tenants

Example Scenario: A delivery driver slips on a wet porch and sprains their wrist. Medical payments coverage pays for their urgent care and physical therapy.

Be Part of Onepoint Insurance Agency Today!

Join a community of dedicated professionals reshaping the future of insurance. With access to unparalleled resources, continuous training, and industry-leading tools, we empower you to build lasting relationships and achieve your career goals. Together, we’re making insurance more accessible and impactful for clients everywhere.

Coverage Area Map