Health Insurance Terms Explained: What You Must Know Before You Enroll

Health Insurance Terms Explained: A Simple Guide to What Really Matters (2025)

Confused by Deductibles and Copays? You’re Not Alone

Picture this: You’re at the doctor’s office, signing forms. They ask about your deductible. Your co-pay. Your out-of-pocket maximum. You nod, but truthfully? You’re not 100% sure what it all means.

If you’ve ever felt confused by health insurance jargon, you’re not alone. Health insurance has a language of its own—and misunderstanding it can cost you time, money, and peace of mind. That's why we've built a resource for those exploring affordable health insurance in Georgia with clarity and confidence. At OnePoint Insurance Agency, we believe you deserve clarity.

In this post, we’ll walk you through the key health insurance terms and plan types—plain and simple—so you can feel confident about protecting your health and your family’s future.

Health Insurance Basics (And Why They Matter)

What Is Health Insurance?

Health insurance is a contract between you and an insurance company. In exchange for a monthly premium, the company agrees to pay part of your medical expenses. But what that "part" includes depends on the specifics of your plan.

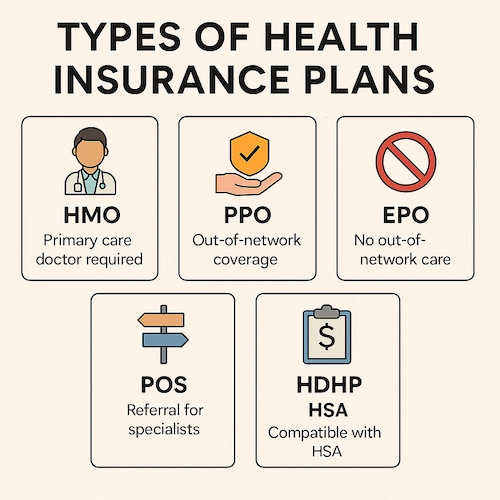

HMO (Health Maintenance Organization): Requires you to choose a primary care doctor and get referrals to see specialists. Typically lower costs, but less flexibility.

PPO (Preferred Provider Organization): More flexibility in choosing doctors and no referrals needed. Higher premiums.

EPO (Exclusive Provider Organization): Like a PPO, but no out-of-network coverage (except emergencies).

POS (Point of Service): A mix of HMO and PPO. You choose a primary care doctor and can go out-of-network with a referral.

HDHP (High-Deductible Health Plan): Lower monthly premiums, higher deductibles; can be paired with a Health Savings Account (HSA).

Health Insurance Terms You Should Know

1. Premium

Your monthly bill—due whether or not you use your insurance.

2. Deductible

The amount you pay out of pocket before insurance begins to cover services.

3. Copay

A fixed fee for a specific service, such as $30 for a doctor visit.

4. Coinsurance

The percentage of costs you share with your insurer after your deductible. For example, you pay 20%, your insurer pays 80%.

5. Out-of-Pocket Maximum

The most you’ll pay in a year. After you hit this number, your insurance pays 100%.

6. In-Network vs. Out-of-Network

In-network providers have agreed-upon rates with your insurer. Out-of-network costs more.

7. Explanation of Benefits (EOB)

A summary of what your insurer covered, what your provider charged, and what you owe.

8. Prior Authorization

Approval required from your insurer before certain procedures or medications are covered.

9. Preventive Care

Routine services like vaccines and annual checkups—usually covered at no cost in-network.

Real-World Scenario – Eric’s Story

Meet Eric, a 40-year-old freelance graphic designer. He chose a high-deductible health plan (HDHP) to save on monthly premiums. He rarely got sick—until one day he woke up with severe abdominal pain. It was appendicitis, and he needed emergency surgery.

Total hospital bill: $18,500

Eric’s deductible: $5,000

Coinsurance: 20%

Out-of-pocket max: $7,500

His Final Costs:

$5,000 deductible

20% of the next $12,500 = $2,500

Total: $7,500 (then insurance covered the rest)

Without insurance, Eric would’ve owed $18,500. With it, he paid less than half.

Lesson: Even if you’re healthy, health insurance protects your financial stability from unexpected emergencies.

Cost Without vs. With Coverage

How much does health insurance save you? Here’s a quick comparison:

Health insurance is a necessity for:

Working Adults – For regular checkups and emergencies

Self-Employed & Freelancers – Protect your income from medical shocks

Retirees – Ensure continued access to care as health needs increase

Parents & Caregivers – Support children’s and dependents’ health needs

Young Adults – One accident can cost thousands

People with Chronic Conditions – Manage long-term care affordably

Low-Income Families – Affordable plans and subsidies make coverage possible

Lifestyle Tip: Travel often? Look into nationwide coverage and telehealth options.

FAQs – Questions We Hear Every Day

Q: What’s the difference between an HSA and FSA?

A: HSAs roll over and are for HDHPs. FSAs are employer-based and don’t roll over.

Q: What if I miss Open Enrollment?

A: You may qualify for Special Enrollment after major life events (e.g. marriage, birth).

Q: Does dental or vision come with health insurance?

A: Often sold separately or as add-ons.

Q: Can I switch plans mid-year?

A: Only during Special Enrollment or if your employer allows it.

Let’s Simplify Your Health Insurance Today

Navigating health insurance doesn’t have to feel like decoding a foreign language. With the right support, you can make informed choices for your health and your finances.

At OnePoint Insurance Agency, we take the time to understand your needs before recommending coverage. We’re not just quoting rates—we’re helping you make smart decisions that protect your life. Discover expert health insurance advisors who are ready to support your needs.

📞 Call us today orexplore your Health Insurance options with OnePoint. Real people. Real answers. That’s the OnePoint promise.