Health / ACA

Marketplace & subsidies

Stay protected with plans that work for your needs, budget, and lifestyle. OnePoint makes Health Insurance simple, so you can focus on living well.

Health insurance is essentially a contract between you (the insured) and an insurance company. You agree to pay a premium (monthly, quarterly, or annually), and in return, the insurer helps cover the cost of your medical expenses.

In the U.S. especially, healthcare isn’t cheap. An ER visit can run you $2,000–$5,000. Surgery? Tens of thousands. Cancer treatment? Hundreds of thousands. Health insurance shields you from bearing the full brunt of those costs.

Navigate your coverage with confidence. Click on any term to learn more about what it means and how it affects your healthcare costs.

Still have questions? Our licensed agents are here to help you understand your options.

Save when you combine health insurance with dental, accident, vision, disability income, and more.

Pays YOU cash when you’re admitted to the hospital

Up to $2,000 per day for hospital stays use for rent, food, travel, or medical bills

Pays a lump sum for covered accidents like fractures, burns, or ER visits

Get up to $20,000 depending on injury severity

One-time cash payout if diagnosed with serious conditions like cancer, heart attack, stroke

Up to $100,000 to help you recover without financial stress

Routine cleanings, X-rays, exams, glasses, and contacts

Save on preventive care & eyecare with network discounts

Replaces a portion of your income if illness or injury keeps you from working

Monthly income payments to help cover living expenses

Save when you combine health insurance with dental, accident, vision, disability income, and more.

Pays YOU cash when you’re admitted to the hospital

Up to $2,000 per day for hospital stays use for rent, food, travel, or medical bills

Pays a lump sum for covered accidents like fractures, burns, or ER visits

Get up to $20,000 depending on injury severity

One-time cash payout if diagnosed with serious conditions like cancer, heart attack, stroke

Up to $100,000 to help you recover without financial stress

Routine cleanings, X-rays, exams, glasses, and contacts

Save on preventive care & eyecare with network discounts

Replaces a portion of your income if illness or injury keeps you from working

Monthly income payments to help cover living expenses

At OnePoint Insurance Agency, we guide you through your options whether you’re enrolling for the first time, switching plans, or qualifying due to a life change. Here’s how to take action based on your eligibility:

🗓 Nov 1 – Jan 15

🗓 Nov 1 – Jan 15

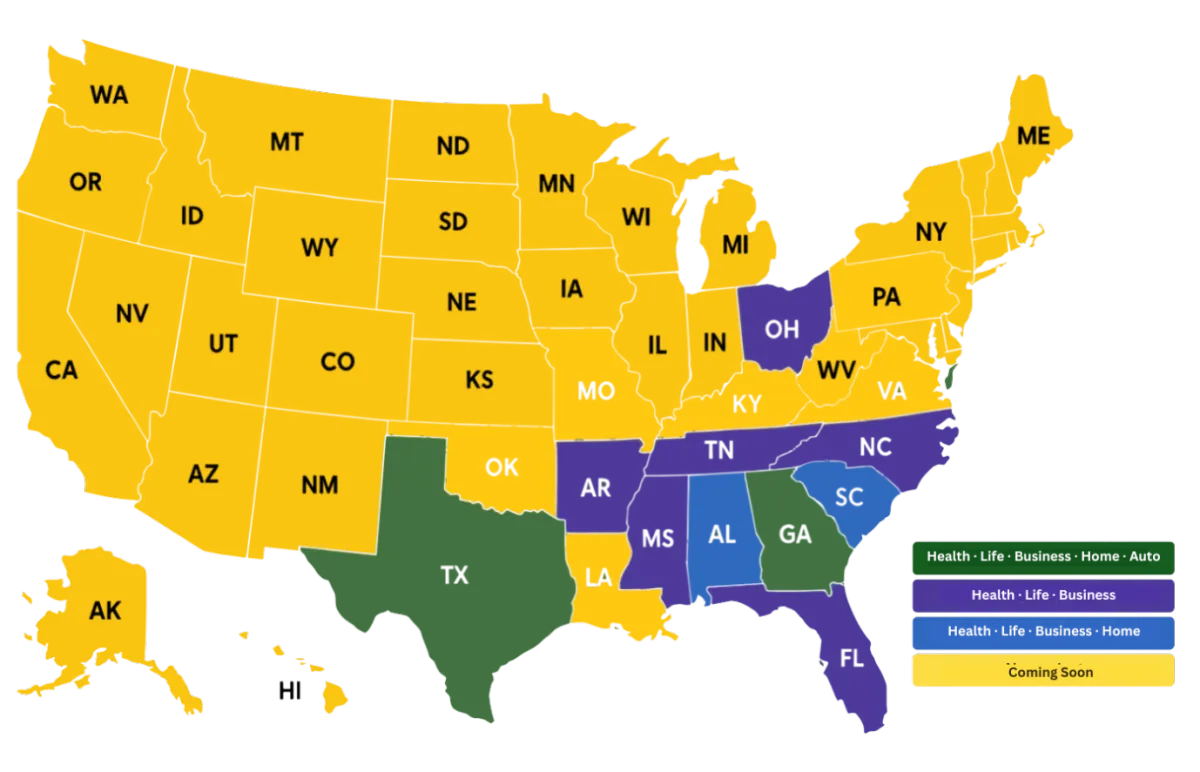

Our licensed agents are trained & certified in multiple states. Call us or let us call you!

Real experiences from real people who trust OnePoint Insurance

ABOUT OUR INSURANCE

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

OnePoint, we believe every client deserves to understand what they’re paying for. Whether you're insuring your car, protecting your home, covering your family, or planning for retirement, we're here to help you make smart, confident choices.

If your household income meets certain federal guidelines, you may qualify for subsidies that reduce your premium to zero. Use our quote tool to check instantly.

Marketplace plans are ACA-compliant and cover essential health benefits; Short Term plans are limited coverage meant for temporary gaps.

Marketplace coverage starts based on enrollment windows. Short Term Medical can start as soon as tomorrow in many states

No. There’s no fee to apply for coverage. Our agents will help you compare options for free

It pays cash directly to you — up to $2,000 per day — if you’re admitted to the hospital. You can use the money for anything

It depends on the plan network. We’ll help you choose a plan that includes your provider when available.

We’re here to make insurance feel simple, clear, and stress-free. At OnePoint Insurance Agency, we’ll help you find the right coverage so you can focus on living, while we protect the things that matter most.

555 NorthPoint Center E

Suite 400

Copyright 2026. OnePoint Insurance Agency. All Rights Reserved.