Why Life Insurance Is the Smartest Investment You’ll Ever Make

Planning for the “What If”

We all have those quiet moments where life’s big questions drift in—What would happen to my family if I wasn’t here tomorrow? Would they be okay? Could they stay in the home we built, keep their future plans intact, and grieve without financial strain?

It’s not exactly cocktail party conversation, but it is real life. And thinking about these “what ifs” isn’t morbid—it’s responsible. At OnePoint Insurance Agency, we believe that preparing for the future is one of the most powerful things you can do for the people you love. That’s why we often say: life insurance isn’t just protection—it’s peace of mind, a legacy, and one of the smartest investments you’ll ever make.

In this post, we’ll walk through the types of life insurance, how it works, who needs it most, and what it can really save you—financially and emotionally—when life throws the unexpected your way.

UNDERSTANDING LIFE INSURANCE: A SIMPLE OVERVIEW

At its core, life insurance is a contract. You pay premiums to a company, and in return, they agree to pay a lump sum to your chosen beneficiaries when you pass away. This payout—called a death benefit—can help cover everything from funeral costs to mortgage payments, college tuition, or simply replacing lost income.

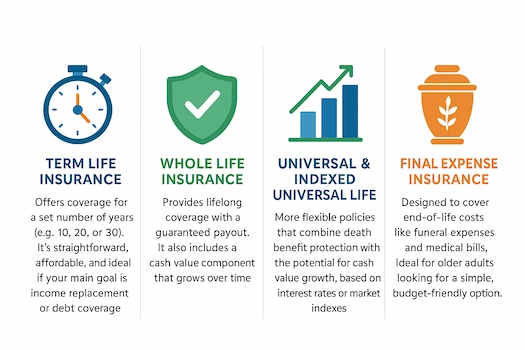

Common Policy Types:

Term Life Insurance: Offers coverage for a set number of years (e.g., 10, 20, or 30). It’s straightforward, affordable, and ideal if your main goal is income replacement or debt coverage.

Whole Life Insurance: Provides lifelong coverage with a guaranteed payout. It also includes a cash value component that grows over time.

Universal and Indexed Universal Life: More flexible policies that combine death benefit protection with the potential for cash value growth, based on interest rates or market indexes.

Final Expense Insurance: Designed to cover end-of-life costs like funeral expenses and medical bills. Ideal for older adults looking for a simple, budget-friendly option.

Explore our life insurance coverage options

REAL-LIFE CASE STUDY: THE DIFFERENCE PREPAREDNESS MAKES

Meet Carla and Tom. They were both 42, raising two teenagers, and had just purchased their first home. Tom had group life insurance through work, but no individual policy. Carla, a stay-at-home mom, wasn’t insured at all.

Tragically, Tom died in a car accident.

The $50,000 from his employer policy covered the funeral and a few months’ bills—but it wasn’t enough to keep the mortgage going or fund their kids’ college accounts. Carla had to sell the house within the year and take on two jobs just to stay afloat.

Now contrast that with Greg, a OnePoint client and small business owner. He had a 30-year term policy for $500,000, plus a modest whole life policy he’d built up since his 20s. When Greg passed away unexpectedly from a heart condition, his family was devastated—but financially secure. His wife paid off their home, kept the business running, and their children finished college debt-free.

The difference? Preparation.

THE HIDDEN COSTS OF GOING UNINSURED

Without life insurance, the financial toll of an unexpected loss can be staggering. Here’s a look at what families often face

When you think of life insurance as a financial cushion—not just a death benefit—it becomes clear: it’s not about betting on the worst. It’s about ensuring your family’s best outcome in any situation.

WHO REALLY NEEDS LIFE INSURANCE?

Short answer? Most people. But here’s a breakdown of groups who benefit the most:

Parents with young children – To replace income, cover childcare, or fund education.

Homeowners – So loved ones can keep the family home.

Business owners – To protect employees, partners, or pass a business on seamlessly.

Married couples – To protect one another from sudden loss of income or debts.

Caretakers – If you provide financial support for aging parents or dependents.

Retirees on fixed incomes – For final expenses or legacy planning.

Freelancers and self-employed individuals – Since you don’t have employer-provided life insurance.

We also work closely with contractors, truckers, restaurant owners, and more—offering tailored advice based on your lifestyle and income patterns.

MAKE THE SMARTEST MOVE TODAY

At OnePoint, we don’t just quote policies—we help you plan for your family’s future like it’s our own. Whether you’re just getting started or reassessing coverage after a life change, our licensed advisors take the time to understand your needs and build a plan that fits.

No pressure. No gimmicks. Just personalized guidance you can trust.

Explore life insurance options and schedule a free consultation