— where your peace of mind is our priority.

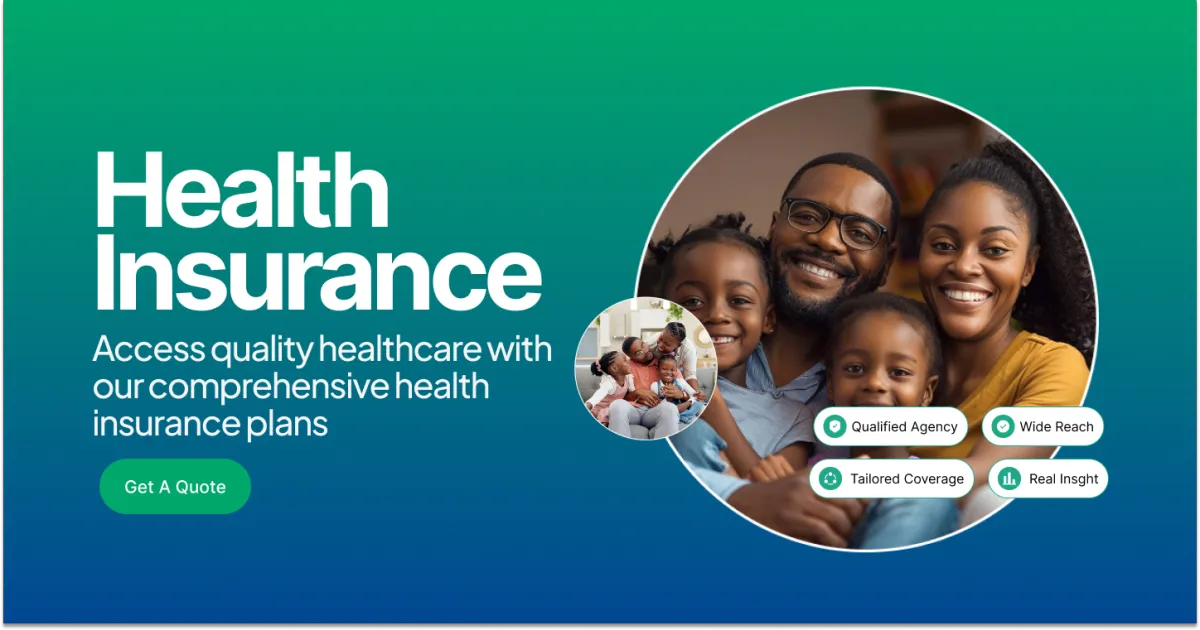

We are committed to offering comprehensive, tailored insurance solutions that protect you, your family, and your business from the unpredictability of life.

providing tailored coverage,

designed to match your unique needs.

Our expert team, armed with extensive industry knowledge, offers you the most advantageous advice while ensuring unparalleled customer service at every step of your insurance journey. By partnering with top-rated insurance providers, we deliver the best policies at competitive rates. At OnePoint, we're not just an insurance agency; we're your trusted partner in securing a worry-free future. Experience the OnePoint difference today!

providing tailored coverage,

designed to match your unique needs.

Our expert team, armed with extensive industry knowledge, offers you the most advantageous advice while ensuring unparalleled customer service at every step of your insurance journey. By partnering with top-rated insurance providers, we deliver the best policies at competitive rates. At OnePoint, we're not just an insurance agency; we're your trusted partner in securing a worry-free future. Experience the OnePoint difference today!

Our Partners

Short Term Medical Insurance

Short Term Medical Insurance — Complete Guide for 2025

🔹 What Is Short Term Medical Insurance?

Short Term Medical Insurance (STM) is a type of temporary health insurance designed to provide coverage for individuals who experience a gap in traditional health insurance coverage. These plans are flexible, affordable, and can go into effect quickly—sometimes as early as the next day after application approval.

Unlike ACA (Affordable Care Act) plans, short term health insurance is not regulated by ACA mandates, which means it does not cover essential health benefits like maternity, mental health, or pre-existing conditions. However, for many people, it provides a cost-effective and fast safety net when other options are unavailable.

Who Should Consider Short Term Medical Insurance?

Short term medical insurance is best suited for people who:

Recently lost a job or are in between jobs

Missed the ACA Open Enrollment Period and do not qualify for a Special Enrollment Period

Are aging off a parent’s health plan (turning 26)

Are part-time, gig economy, or freelance workers without employer-sponsored health insurance

Are waiting for new ACA coverage or employer coverage to begin

Are early retirees not yet eligible for Medicare

Are college graduates entering the workforce

If you're healthy and just need temporary, minimal coverage in case of accidents or illness, short term insurance can be an effective solution.

Key Features of Short Term Health Insurance

✔ Fast Enrollment & Immediate Coverage

Short term plans can be activated within 24 hours of approval. This makes them a great solution for urgent needs and unexpected gaps.

✔ Flexible Terms

Coverage durations range from 30 days to 364 days, and some states allow you to reapply for up to 36 months of continuous coverage.

✔ Low Monthly Premiums

These plans typically cost much less than ACA plans, especially for younger and healthier applicants. This is because they don't cover everything, and they assess risk before issuing coverage.

✔ Customization

You can often choose your:

Deductible level (from $1,000 to $10,000)

Coverage maximum (e.g., $250,000 to $2 million)

Doctor network or any doctor (depending on the carrier)

Coinsurance percentage (typically 20%–50%)

What Short Term Medical Insurance Does Not Cover

Because STM plans are exempt from ACA regulations, they come with significant limitations:

Not Covered

Explanation

Pre-existing conditions

Anything diagnosed or treated in the last 1–5 years may be excluded

Maternity care

Pregnancy-related services and childbirth are generally excluded

Mental health & substance abuse

These are rarely included in STM coverage

Preventive care

Unlike ACA plans, things like physicals or immunizations are not free

Prescription drugs

Only some short term plans offer limited Rx coverage

Example Use Cases

Here are three real-world scenarios where short term coverage is a great fit:

Maria Recent College Graduate

Maria just finished school and is freelancing for a few months before committing to a full-time role. She doesn’t qualify for ACA subsidies and needs basic protection. Short term insurance gives her peace of mind for ER visits and unexpected illness until she gets a permanent job.

Jason & Megan Waiting for Employer Coverage

They just moved to a new state and Jason’s job health benefits begin in 60 days. They purchase a 90-day short term plan with a $2,500 deductible to bridge the gap affordably.

Robert Self-Employed and Healthy

As a full-time contractor, Robert is in good health and doesn’t need comprehensive ACA coverage. He opts for a 6-month short term plan with $1 million in coverage to protect himself from major medical events.

Always check with a licensed agent to confirm availability and term length in your state.

Cost Comparison: Short Term vs. ACA Plan (Example)

Plan Type

Monthly Premium

Deductible

Covers Pre-Existing Conditions

Drug Coverage

Max Out-of-Pocket

Short Term Plan

$90

$5,000

❌ No

Limited or ❌ None

$10,000

ACA Silver Plan (with subsidy)

$120

$1,000

✅ Yes

✅ Yes

$2,500

If you’re healthy and in between coverage, the short-term plan is cheaper. But if you have medical needs or qualify for a subsidy, ACA plans offer much more value.

Your Questions Answered

What types of insurance does OnePoint Insurance Agency offer?

OnePoint Insurance Agency offers a wide range of insurance products, including home, auto, life, business, group health, group disability income, individual disability income, long-term care, short-term care, and critical illness insurance.

Where is OnePoint Insurance Agency located?

Our office is located in 555 North Point Center E Suite 400, Alpharetta, GA 30022

How can I get an insurance quote from OnePoint Insurance Agency?

You can get an insurance quote by visiting our website and filling out a quote request form, calling our office, or scheduling an appointment with one of our agents.

What makes OnePoint Insurance Agency different from other insurance agencies?

OnePoint Insurance Agency is an independent agency, meaning we can shop around with multiple insurance carriers to find the best coverage and rates for our clients. We also provide personalized service and tailored solutions to fit each client's unique needs.

How can I contact OnePoint Insurance Agency for customer service?

You can contact us by phone, email, or through our website's contact form using this link Our customer service team is available to assist you during our regular business hours.

Do you offer any discounts on insurance policies?

Yes, we offer various discounts on insurance policies, depending on the type of insurance and the specific carrier. Our agents can help you identify and apply any available discounts to your policy.

Can OnePoint Insurance Agency help with claims?

Absolutely. Our team is here to assist you throughout the claims process, ensuring you receive the support and guidance needed to resolve your claim efficiently.

What information do I need to provide to get an accurate insurance quote?

To provide an accurate insurance quote, we typically need information such as your personal details, property or vehicle information, coverage preferences, and any relevant history or documentation.

Does OnePoint Insurance Agency offer coverage for small businesses?

Yes, we offer a range of insurance products tailored specifically for small businesses, including liability insurance, property insurance, business overhead disability insurance, and more.

How can I leave a review for OnePoint Insurance Agency?

You can leave a review for OnePoint Insurance Agency on Google by following the link provided in our email or text message, or by searching for our agency on Google and selecting the option to write a review.

Address

555 North Point Center E Suite 400, Alpharetta, GA 30022

Phone No.

770-884-8117

Fax

770-884-8117

Social media

Legal

Privacy policy

Terms and conditions

©Copyright | OnePoint Insurance Agency. All Right Reserved

Information

About Us

Blog

©Copyright | OnePoint Insurance Agency. All Right Reserved