General Liability

Bodily injury & property damage for attendees and third parties.

From weddings to corporate events, Event Insurance protects your big day from unexpected surprises.

Planning an event, whether it’s a wedding, birthday party, concert, or corporate gala, takes months of work and often thousands of dollars. But even the most carefully planned events can run into unexpected problems. A guest could slip and fall, a vendor might fail to show up, or severe weather could force you to cancel altogether. Without protection, you could be left covering the financial fallout yourself.

Most venues now require proof of event liability insurance before you can even sign a contract. Why? Because accidents happen, and they don’t want to be held responsible if things go wrong.

Protects against claims of bodily injury, property damage, or advertising injury. Required by landlords, clients, or licensing boards.

Covers buildings, inventory, furniture, and business equipment.

Available as part of a Business Owners Policy (BOP).

Combines general liability + property + loss of income.

Ideal for small to midsize businesses.

Covers mistakes, errors, or omissions in your work.

Essential for consultants, real estate pros, and service-based businesses.

Covers company-owned vehicles or employees using cars for work. Includes liability, physical damage, and hired/non-owned auto.

Mandatory in most states once you hire employees.

Covers work injuries, medical costs, and lost wages.

Protects against hacking, data breaches, and digital theft.

Highly recommended for businesses with customer data or e-commerce.

Adds extra liability coverage above all other policies.

Protects your assets from major lawsuits or claims.

From rain delays to rowdy dance floors—protect your guests, your venue, and your budget with coverage built for real events.

Bodily injury & property damage for attendees and third parties.

Reimburses non-refundable costs if your event can’t go on.

Protection when alcohol is served.

Medical bills for guests, volunteers, or participants.

Protects the venue space you’re renting.

Coverage for sound, lighting, staging, tents & A/V.

Rain or severe weather protection for outdoor events.

Protection when you’re responsible for others’ property.

Liability for errands and rentals tied to your event.

Fast COIs to satisfy venue and vendor requirements.

If you’re hosting people, renting a space, serving food, selling tickets, or hiring vendors—you’re the target audience.

Covers venue damage, last-minute cancellations, liquor liability, and vendor no-shows.

Birthdays, anniversaries, reunions—protect hosts from property damage and guest injuries.

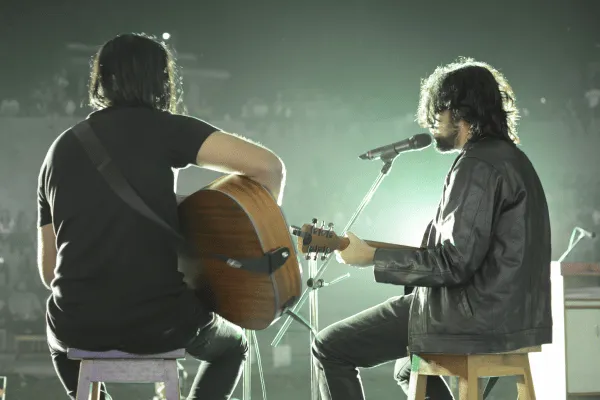

Promoters, artists, and venues—coverage for crowd injuries, equipment, and rainouts.

Offsites, conferences, launches—general liability, rented space damage, and cancellations.

Street fairs, food fests, markets—multi-vendor events with large crowds and complex risk.

Galas, auctions, charity runs—protect organizers, volunteers, and donors’ experiences.

Tournaments, races, leagues—spectator and participant injury liability plus weather risks.

Graduations, dances, field days—temporary coverage without altering annual policies.

Solutions for online and physical stores to boost sales and streamline operations.

Read More →Tools to attract diners, manage bookings, and grow your food business.

Read More →Support for agents, brokers, and managers to close deals faster.

Read More →Build stronger client relationships and manage projects efficiently.

Read More →Engage communities, manage donations, and grow your mission.

Read More →Solutions for salons, spas, and barbershops to attract and retain clients.

Read More →For legal, finance, and consulting firms to manage clients effectively.

Read More →Industry solutions to scale operations and serve clients better.

Read More →

Fast, personalized quotes

Affordable plans with flexible options

Dedicated agents who understand small businesses

Claims support when you need it most

OnePoint, we believe every client deserves to understand what they’re paying for. Whether you're insuring your car, protecting your home, covering your family, or planning for retirement, we're here to help you make smart, confident choices.

Real experiences from real people who trust OnePoint Insurance

ABOUT OUR INSURANCE

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Insurance doesn't have to be complicated. Get easy explanations for all your questions.

Get a policy that’s built around your business needs and budget.

We’re here to make insurance feel simple, clear, and stress-free. At OnePoint Insurance Agency, we’ll help you find the right coverage so you can focus on living, while we protect the things that matter most.

555 NorthPoint Center E

Suite 400

Copyright 2026. OnePoint Insurance Agency. All Rights Reserved.