Drive confident. We’ve got you covered.

Auto protection for every road, every driver, every budget.

Health Coverage when you need it most.

Drive confidently with complete coverage.

Protect your business operations and assets.

Security and peace for your property and family.

Support and legacy protection for your loved ones.

Stay financially stable during disability periods.

Comprehensive, flexible coverage designed to protect your life, assets, and future with simplicity and care.

Coverage for life’s milestones from your first apartment to your family home, your first car to your retirement plan.

Auto. Home. Life. Health. Disability Income. Accident. Critical illness. Hospitalization insurance Peace of mind at every stage

Protect your business, your staff, and your assets,whether you operate from home or manage a fleet..

Commercial auto, general liability, workers comp, property, and more.

Whether you're clocking in, running a crew, or building something from scratch, OnePoint is here with insurance that fits your lifestyle, your risks, and your goals

At OnePoint, we believe every client deserves to understand what they’re paying for. Whether you're insuring your car, protecting your home, covering your family, or planning for retirement, we're here to help you make smart, confident choices.

You bet we do! Bundling your home, auto, and life insurance can lead to serious savings—plus it simplifies your coverage under one roof. We’ll help you find the best combo for your needs and budget

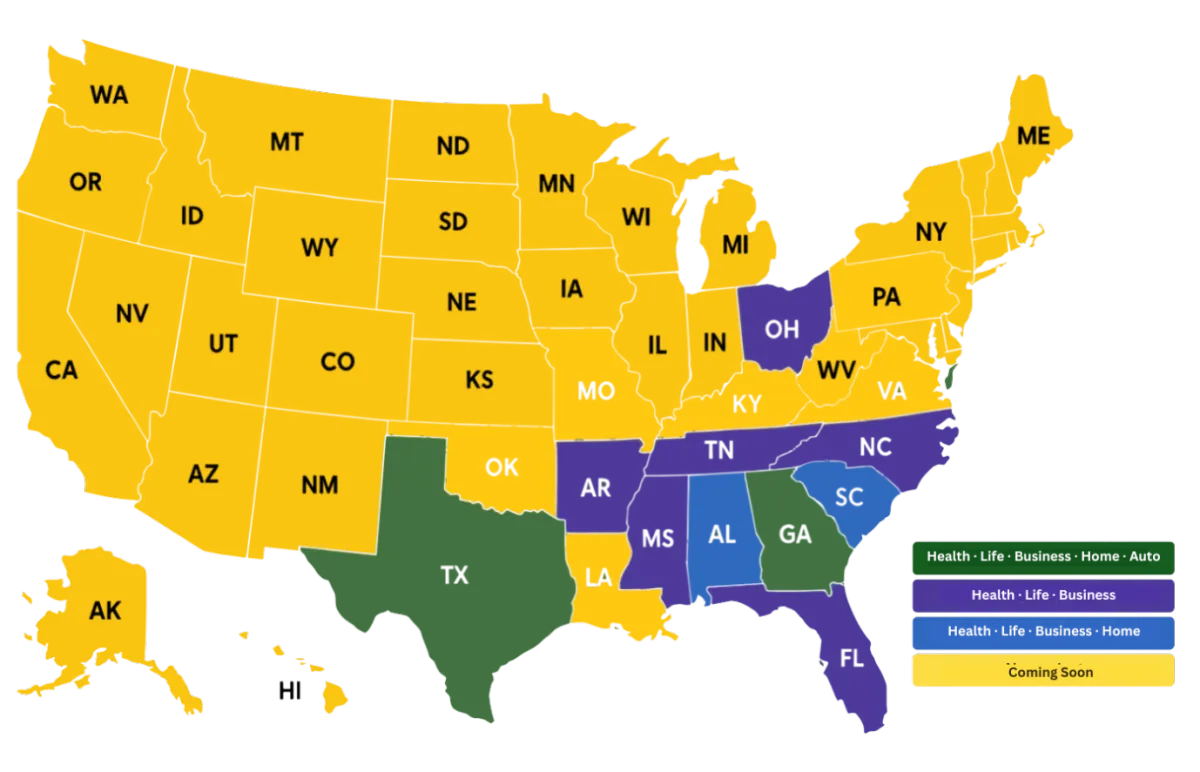

A: Yes! We’re licensed in Texas, Florida, Alabama, Arizona, Louisiana, Maryland, Michigan, Mississippi, Illinois, Arizona, South Carolina, North Carolina, Tennessee, New York, New Jersey, Missouri, Tennessee, Virginia and we’re adding more states. Missing your state, yes? Give us a ring Call 770-884-8117.

Absolutely. We make switching easy. Whether your current policy is about to renew or you just want better service, we’ll guide you through the handoff without missing a beat

Yes, we work with businesses of all shapes and sizes from home-based startups to fleets and storefronts. General liability, workers comp, commercial auto, cyber, professional liability you name it, we’ll quote it.

100% yes. Our quotes are free, fast, and come with zero pressure. You get real info and real pricing—no strings attached.

We offer term life, whole life, universal life (including Indexed Universal Life/IUL for flexible coverage with cash value growth), and final expense insurance.

Call, text, or click. We’re ready when you are.

888-899-8117

555 NorthPoint Center E, Alpharetta

Georgia. 30022

Owning a bar or restaurant in Georgia can be a rewarding venture. However, it also comes with significant risks, particularly when alcohol is involved. Understanding these risks and securing the proper insurance coverage is crucial for protecting your business and its assets.

Serving alcohol can expose your establishment to a variety of liabilities, including:

Dram Shop Laws: Georgia has strict dram shop laws, which hold establishments responsible for injuries or damages caused by intoxicated patrons. This can include car accidents, assaults, and property damage.

Over-Serving: Serving alcohol to minors or visibly intoxicated patrons can result in severe legal and financial consequences.

On-Premises Accidents: Slip and falls, fights, and other accidents can occur on your premises, potentially leading to lawsuits.

To safeguard your business from these risks, consider the following insurance coverage:

Liquor Liability Insurance: This is a specialized policy that covers claims arising from the serving of alcohol. It protects your business from lawsuits related to injuries or property damage caused by intoxicated patrons.

General Liability Insurance: This broader policy covers bodily injury, property damage, and personal injury claims that may arise from your business operations, including slip and falls, food poisoning, and property damage.

Commercial Property Insurance: This protects your physical assets, such as buildings, equipment, and inventory, from losses due to fire, theft, vandalism, and other covered perils.

Business Income Insurance: This coverage helps replace lost income if your business is temporarily closed due to a covered loss, such as a fire or natural disaster.

Employee Liability Insurance: This protects your business from claims made by employees for workplace injuries or illnesses.

Employee Training: Conduct regular training for your staff on responsible serving practices, alcohol awareness, and how to handle intoxicated patrons.

Risk Management: Implement policies and procedures to minimize the risk of accidents and incidents.

Policy Review: Regularly review your insurance policies to ensure they adequately protect your business.

By understanding the risks associated with serving alcohol and obtaining the appropriate insurance coverage, you can protect your Georgia bar or restaurant from financial ruin. Consulting with an experienced insurance agent can help you determine the specific coverages your business needs.

Protect Your Business with OnePoint Insurance Agency. Our experienced agents can tailor a liquor liability insurance package to fit your specific needs. Contact us today for a free quote.

Get insurance tips, plan updates, and exclusive offers from OnePoint.

We’re here to make insurance feel simple, clear, and stress-free. At OnePoint Insurance Agency, we’ll help you find the right coverage so you can focus on living, while we protect the things that matter most.

Copyright 2025. OnePoint Insurance Agency. All Rights Reserved.