Drive confident. We’ve got you covered.

Auto protection for every road, every driver, every budget.

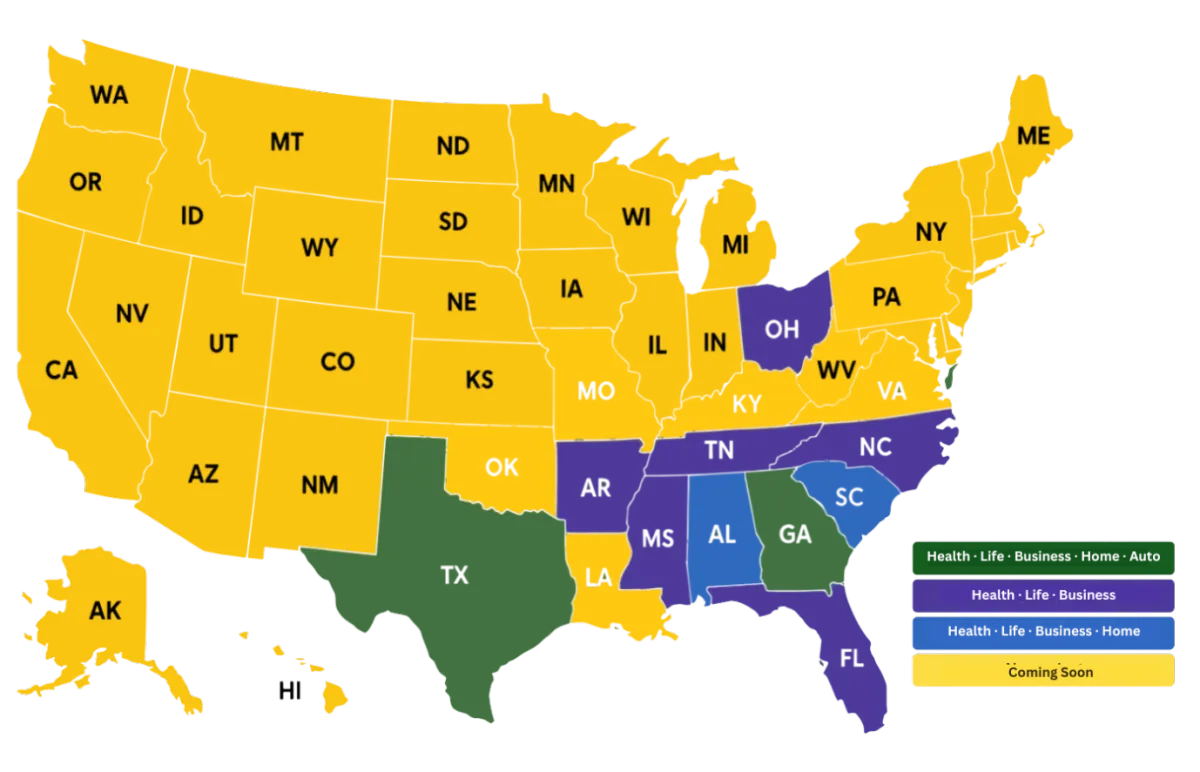

Explore our comprehensive range of insurance products designed to protect what matters most to you.

Health Coverage when you need it most.

Drive confidently with complete coverage.

Protect your business operations and assets.

Security and peace for your property and family.

Support and legacy protection for your loved ones.

Stay financially stable during disability periods.

Comprehensive, flexible coverage designed to protect your life, assets, and future with simplicity and care.

Access common services quickly and easily. We're here to make managing your insurance simple.

No matter who you are, we've got coverage that fits your life perfectly.

Coverage for life's milestones—from your first apartment to your family home, your first car to your retirement plan.

Protect your business, your staff, and your assets—whether you operate from home or manage an entire fleet.

Whether you're clocking in, running a crew, or building something from scratch, OnePoint is here with insurance that fits your lifestyle, your risks, and your goals

From healthcare heroes to hardworking families, we provide coverage that fits every lifestyle and profession.

Insurance Client

Real answers. Straight talk. Insurance made simple.

At OnePoint, we believe every client deserves to understand what they're paying for. Whether you're insuring your car, protecting your home, covering your family, or planning for retirement, we're here to help you make smart, confident choices.

Call, text, or click. We’re ready when you are.

888-899-8117

555 NorthPoint Center E, Alpharetta

Georgia. 30022

Imagine this: You're at your peak, crushing your career goals, living life to the fullest. Then, bam! An unexpected accident or illness throws your world upside down. Suddenly, working becomes impossible, and your income grinds to a halt.

This isn't just a hypothetical scenario. According to the Social Security Administration, nearly 25% of working adults will experience a disability lasting at least three months before reaching retirement age. That's one in four people facing the very real possibility of losing their paycheck due to circumstances beyond their control.

That's where disability insurance comes in. It's your financial superhero, stepping in to replace a portion of your income if you're unable to work due to a covered disability. It's the safety net that catches you when life throws you a curveball, ensuring you can focus on recovering and getting back on your feet without the added stress of financial burdens.

Yes, there is! SSDI is a government program that provides benefits to individuals with disabilities who meet strict criteria. However, the approval process can be long and tedious, and benefits may not be enough to cover all your expenses. This is where private disability insurance shines.

Think of private disability insurance as your own personal insurance policy, customized to your specific needs and lifestyle. You choose the benefit amount, the elimination period (how long you wait before benefits kick in), and the coverage duration (how long benefits last). It's your safety net, woven with your own financial threads.

You choose a policy and pay premiums: Just like any other insurance, you'll pay monthly or annual premiums to keep your policy active.

A covered disability strikes: This could be anything from an accident or illness to a musculoskeletal disorder or mental health condition. Your policy outlines the specific conditions covered.

You file a claim: Contact your insurance company and provide necessary documentation to support your claim.

Your benefits kick in: After the elimination period, you'll start receiving a portion of your pre-disability income, typically around 50-60%. This helps cover your essential expenses while you focus on recovery.

The cost of disability insurance depends on several factors like your age, occupation, health, and chosen benefit amount. However, it's important to remember that the cost of being unprepared for a disability can be far greater.

Think about it: Medical bills, living expenses, and lost income can quickly pile up, creating a financial crisis on top of a personal one. Disability insurance offers peace of mind knowing you have a financial cushion to fall back on.

Protects your family: Your loved ones won't have to shoulder the financial burden if you're unable to work.

Provides peace of mind: Knowing you're financially protected allows you to focus on recovery without worry.

Helps maintain your lifestyle: Disability insurance can help you keep up with your mortgage, car payments, and other essential expenses.

May offer tax benefits: Depending on your policy and tax situation, your premiums may be tax-deductible.

Investing in disability insurance is an investment in your future, your family's well-being, and your peace of mind. It's not a matter of "if" something will happen, but "when."

Don't wait for life to happen to you. Take control of your financial security and contact OnePoint Insurance Agency today. We'll help you find the right disability insurance policy that fits your needs and budget.

Remember, disability insurance is the gift that keeps on giving, even when life throws you its toughest punches.

Visit our website or call 770-884-8117 for a free consultation with one of our experienced agents today. We're here to help you build a brighter, more secure future, one that includes protection against the unexpected.

Get insurance tips, plan updates, and exclusive offers from OnePoint.